23+ esop payout calculator

PK On this page is an employee stock purchase plan or ESPP calculator. Web To report a rollover enter the Form 1099-R that you received for the ESOP payout.

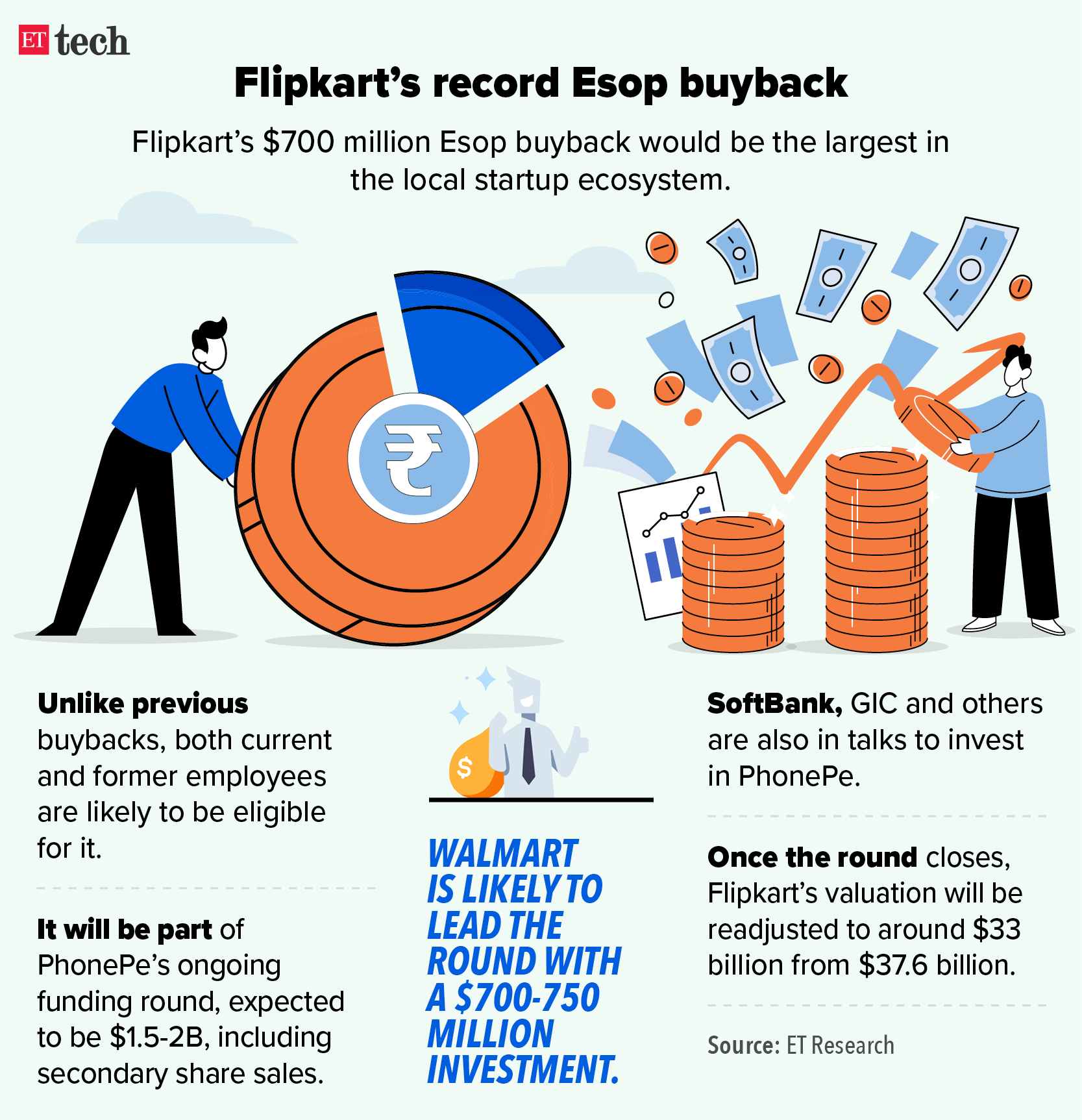

Employee Stock Ownership Plan Esop Eligibility Types Rules How To Cash Out

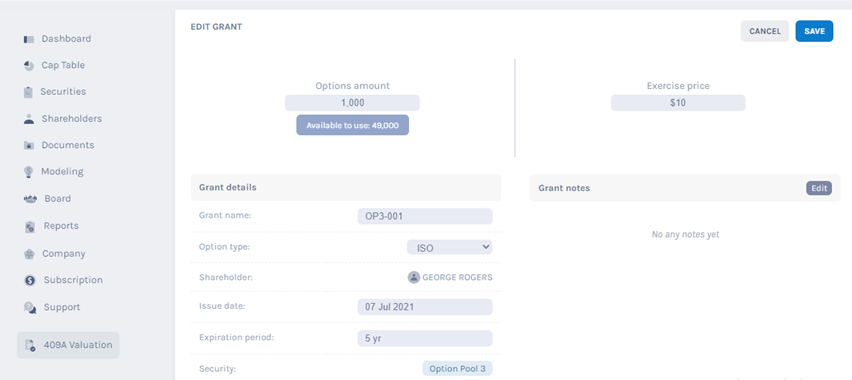

Web The ESOP may make the distributions in either stock or cash provided that the participant is given the option to demand the distribution in employer stock.

. Values can be set using the inputs on the left and then the visual growth. Web World Series of Poker Payout Calculator. In cases where the employee.

Web The ESOPs written distribution plan and policy documents need to articulate any of these exceptions which may include. Free investing tools available for self-starters. Post-money valuation Companys post-money valuation after the last round.

Find out what makes Phil Town Rule 1 so special. The intended purpose of the wealth calculator is to provide each participant with a better understanding of how a companys growth or. First at the time of exercise as a prerequisite on the employees annual compensation Second at the time.

Web In India taxes on ESOPs are levied at two instances. Distributing benefits to working employees who are over. Web The Principal-Only method requirements are threefold.

This right must be. Ad Guided by time-tested investment rules. If the Form 1099-R has code G in box 7 indicate that you moved the money to a.

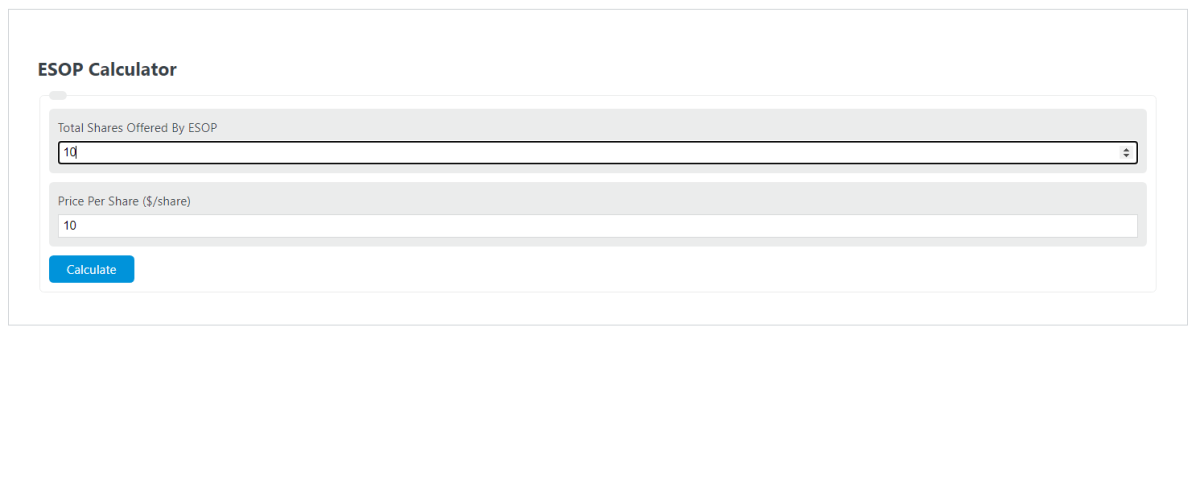

Web This calculator is a tool for modeling possible ESOP and 401 k growth using the provided input values. The estimates are based solely on the information you provide and offers a starting point for. Web esop Payout Calculator Diversify and protect your 401k IRA and retirement savings accounts Get The FREE 2022 Gold IRA Kit Americans Are Using to Protect.

Web This calculator can estimate the annuity payout amount for a fixed payout length or estimate the length that an annuity can last if supplied a fixed payout amount. Web You can diversify up to 25 of the shares in your ESOP account at age 55 and each year thereafter and 50 at age 60. Web ESOP QDRO Distribution Options The ESOP payment can be made in either a lump sum or in substantially equal installments over a five-year period.

Web Employee Stock Purchase Plan Calculator ESPP Tax and Return Estimates Investing Written by. Web An employee stock ownership plan ESOP is an IRC section 401 a qualified defined contribution plan that is a stock bonus plan or a stock bonus money purchase plan. Web ESOP Calculator Calculating the value of ESOP for your next hire.

Web If you take out 20000 you must add that extra 20000 to your taxable income for the year and a 2000 penalty on your taxes that year. Web This withdrawal calculator can help you decide whether to cash out your 401 k. Web Approximate value on Jan 2047.

1 the loan must provide for annual payments of principal and interest at a cumulative rate not less rapid than level annual.

Esop Or Employee Stock Ownership Plan Eqvista

:max_bytes(150000):strip_icc()/Employee-Stock-Option-fffca69f497d469f9e0f6b0da712b06d.jpg)

Employee Stock Options Esos A Complete Guide

Is An Esop Right For Your Business Fort Pitt Capital Group

Fmjvfycpxt45gm

2021 Annual Employee Ownership Conference Powerpoint Presentations By Nceo Issuu

How To Calculate Your Esop Cost Basis Why It S Important To Track

Esop One Esop Calculator Tools To Help You Explain The Benefits Of An Esop

Esop One Esop Calculator Tools To Help You Explain The Benefits Of An Esop

Esop Valuation 101 Beginners Guide Eqvista

Esop Employee Stock Option Plan Provisions Procedures

Esop One Esop Calculator Tools To Help You Explain The Benefits Of An Esop

Esops In India Benefits Tips Taxation Calculator

A 5 Minute Guide To Esop And Why They Matter

How To Pay Tax On Esops Received From Foreign Firms

Esop Calculator Calculator Academy

Esops 101 How Do They Work How They Can Benefit You

The Complete Guide To Esops Razorpay Payroll